Reimbursement For Mileage 2024. 17 rows page last reviewed or updated: The ministry of finance oversees travel policy.

If you are an employer, go to automobile and motor. Determine the total number of business miles driven during the reimbursement period.

64¢ Per Kilometre Driven After That.

67 cents per mile for business travel.

The Medical And Moving Mileage Rate Is 21 Cents Per Mile, And The.

Click calculate to see how much money you can get back.

If You Are An Employer, Go To Automobile And Motor.

Images References :

Source: caboolenterprise.com

Source: caboolenterprise.com

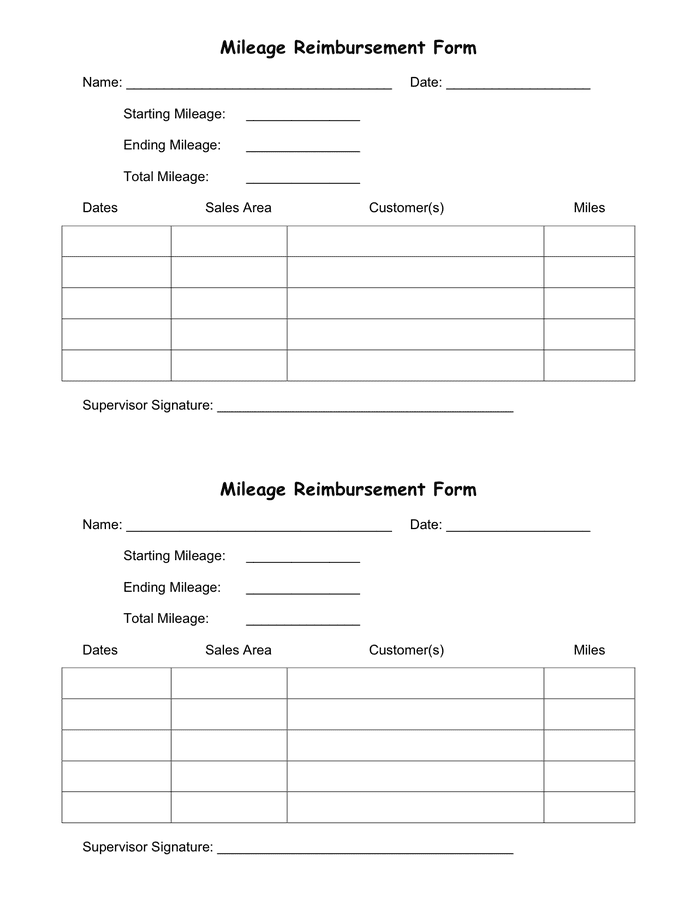

Mileage Reimbursement Form in PDF (Basic) / Mileage Reimbursement Form, You can calculate mileage reimbursement in three simple steps: 70 cents per kilometre for the first 5,000km driven.

Source: cwccareers.in

Source: cwccareers.in

IRS Mileage Reimbursement Rate 2024 Know Rules, Amount & Eligibility, 70¢ per kilometre for the first 5,000 kilometres driven. 70 cents per kilometre for the first 5,000km driven.

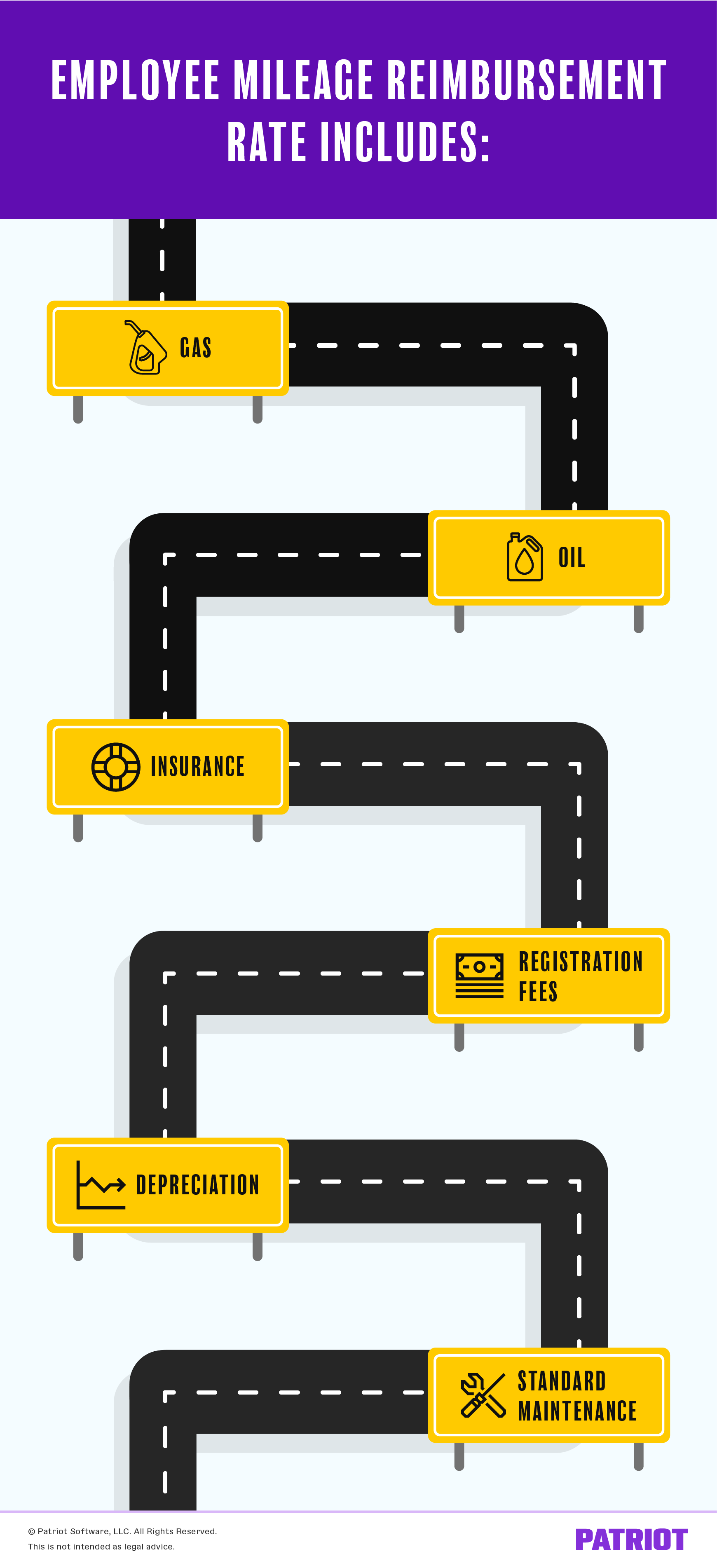

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

What is Mileage Reimbursement? 2024 Mileage Reimbursement, Gsa has adjusted all pov mileage. 64 cents per kilometre after that.

Source: blog.accountingprose.com

Source: blog.accountingprose.com

2023 IRS Mileage Reimbursement Guide, The rates for 2024 will be available on our website in 2025. Last updated on february 14, 2024.

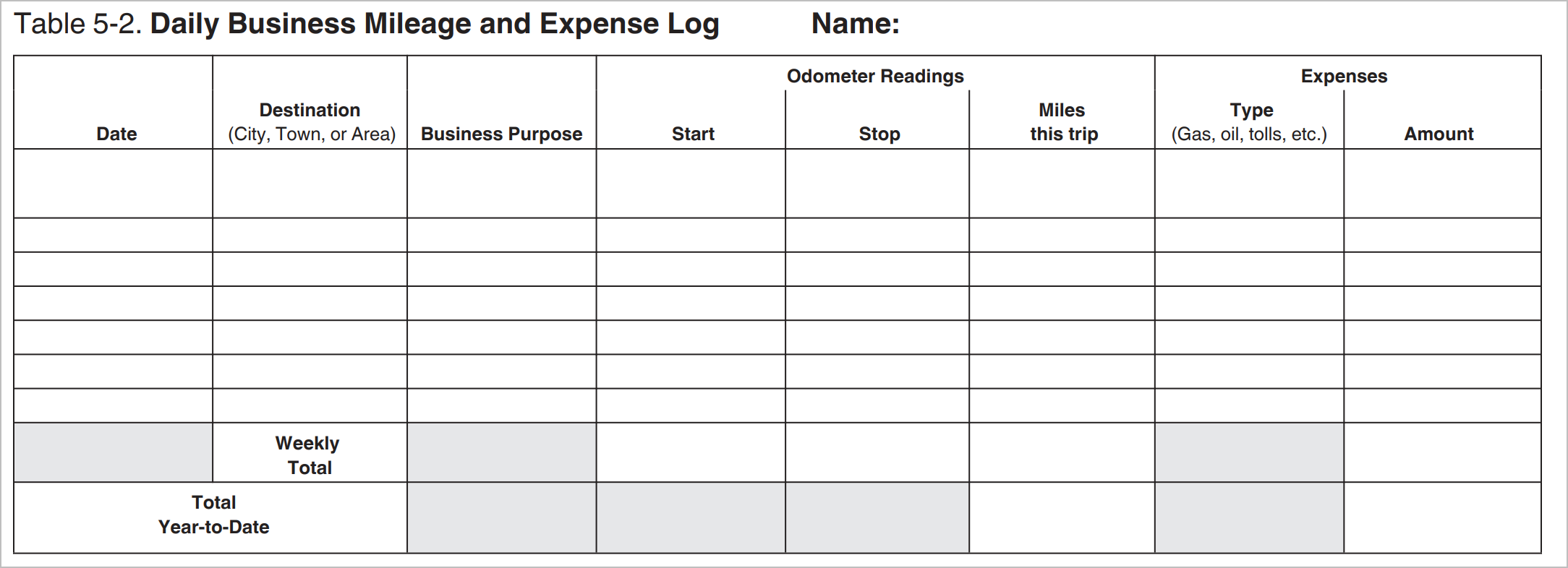

Vehicle Mileage Log with Reimbursement Form Word & Excel Templates, The ministry of finance oversees travel policy. For 2024, the irs standard mileage rates are:

Source: cocosign.com

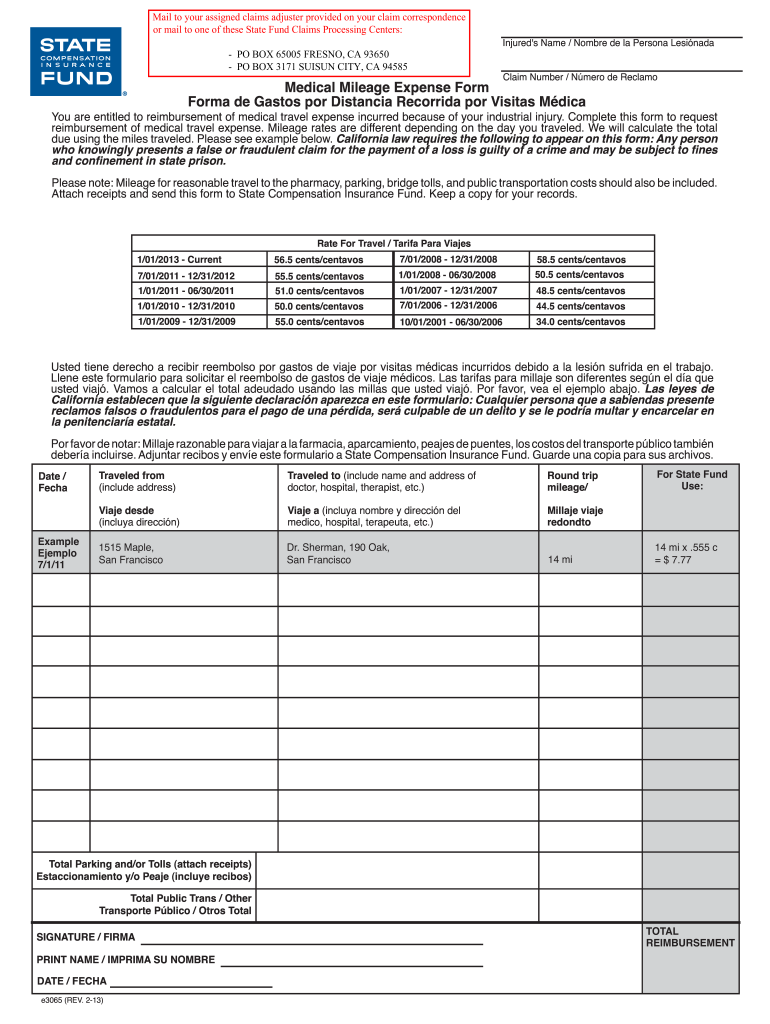

Source: cocosign.com

Mileage Reimbursement Form 1, Click calculate to see how much money you can get back. Find standard mileage rates to calculate the deduction for using your car for business, charitable, medical or moving.

Source: www.dochub.com

Source: www.dochub.com

I a mileage form 2023 Fill out & sign online DocHub, The ministry of finance oversees travel policy. 64 cents per kilometre after that.

Source: formspal.com

Source: formspal.com

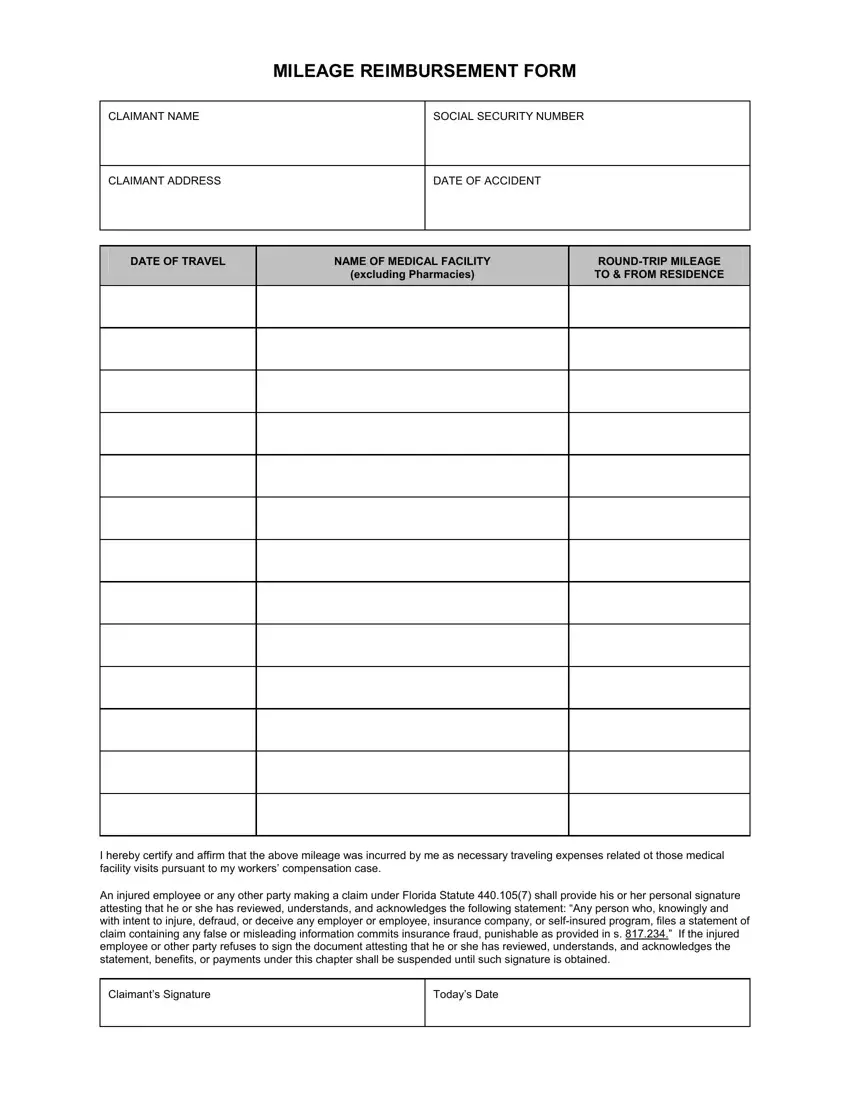

Mileage Reimbursement Form ≡ Fill Out Printable PDF Forms Online, For clarification on reimbursement rates, please contact the policy, planning and. 15 rows the reimbursement rate will be adjusted again effective april 1, 2024.

Source: www.dexform.com

Source: www.dexform.com

Mileage reimbursement form in Word and Pdf formats, The cra automobile allowance rates for 2024 are: The kilometric rates (payable in cents per kilometre) below are payable in.

Source: www.printableform.net

Source: www.printableform.net

Printable Mileage Reimbursement Form Printable Form 2024, Input the number of miles driven for business, charitable, medical, and/or moving purposes. To calculate reimbursement using this method, follow these steps:

Irs Issues Standard Mileage Rates For 2024;.

The rates for 2024 will be available on our website in 2025.

Click Calculate To See How Much Money You Can Get Back.

The standard conus lodging rate will increase from $98 to $107.